You always have the option to do nothing about your credit card debt:

Simply make the minimum monthly payments on your credit card debt. If you continue to make the minimum monthly payments on your credit card debt, creditors will leave you alone because they profit from the compound interest you are paying them. This is not a good option if you cannot make the minimum monthly payments.

The minimum monthly payments you make include a small amount of your actual debt plus an annual percentage rate, which is compounded and calculated on the entire outstanding debt you owe. If you miss a payment or are late, you will likely incur additional penalties and late fee charges. The compound interest you pay makes it very difficult to repay the debt. Your debt-to-income ratio will have a negative impact on your credit score because you do not lower your debt very much. You will pay much more to the credit card company than what you originally purchased with the credit card.

If you continue to use your credit card, you will soon reach the card’s limit, which negatively impacts your credit score, and you may reach a point when you can no longer make the minimum monthly payment.

Credit cards that maintain maximum credit ceilings will negatively affect your credit score. With large outstanding credit debts, you will find it difficult to obtain loans for cars, a home, or additional credit cards, like those for gasoline or department stores.

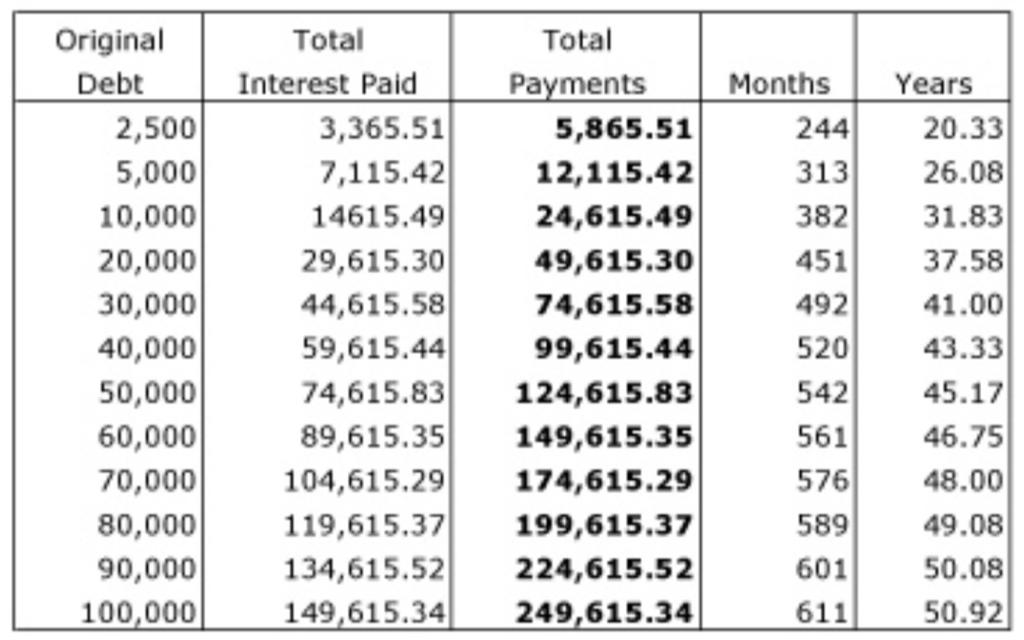

Compounded interest payments are always more than principal payments, making paying off your credit card debt almost impossible when you make minimum payments. Refer to the table below to see that with an original debt amount of $2500, you will pay nearly $6000 back to the credit card company, taking 244 payments (months) and more than 20 years! Doing nothing about your credit card debt but making minimum payments is hard to accept.

We understand the burden that debts can place on individuals and families, and we are committed to helping you overcome these challenges.

Debt settlement services are not appropriate for everyone. Enrollment into the program may be adversely affect creditworthiness; May result in collections or legal motions by creditors or debt collectors; and may increase the balance owed due to accrual of fees and interest by creditors or debt collectors. to pay your monthly bills in a timely manner may result in increased balances and can harm credit ratings. Not all creditors will agree to reduce the principal balance.

Debt-settlement services are not appropriate for everyone. Failure to pay your monthly bills in a timely manner will result in increased balances and will harm your credit rating. Not all creditors may agree to reduce the principal balance, and they may pursue collection, including lawsuits. There are also required verbal and written disclosures and warnings.